- US

- US Money

Noodles & Company has seen a surge in sales, while also battling with raising the low value of its shares

Owen Scott Saturday 17 January 2026 17:31 GMT- Bookmark

- CommentsGo to comments

Bookmark popover

Removed from bookmarks

Close popover

CloseKevin O'Leary blames U.S.-Canada trade war for closure of Jim Beam distillery

CloseKevin O'Leary blames U.S.-Canada trade war for closure of Jim Beam distillery

The latest headlines from our reporters across the US sent straight to your inbox each weekday

Your briefing on the latest headlines from across the US

Your briefing on the latest headlines from across the US

Email*SIGN UP

Email*SIGN UPI would like to be emailed about offers, events and updates from The Independent. Read our Privacy notice

A major fast food brand is bracing for a fresh wave of closures after shuttering 40 restaurants last year.

Colorado-based restaurant Noodles & Company currently has 423 sites across the country, many of which are based on busy highways and in the nation’s bustling malls.

However, after a devastating slew of closures last year, an additional 30 to 35 locations could soon be axed.

The news was confirmed in a press release delivered by the company this week, as the brand looked back on its performance last year.

“Decisions like this are made thoughtfully and with a long-term view of the business,” Joe Christina, the CEO and President of Noodles & Company, said. “These actions are intended to strengthen the overall health of the brand and our financial position, helping to ensure we are well-positioned for profitable growth and long-term value creation for our shareholders.”

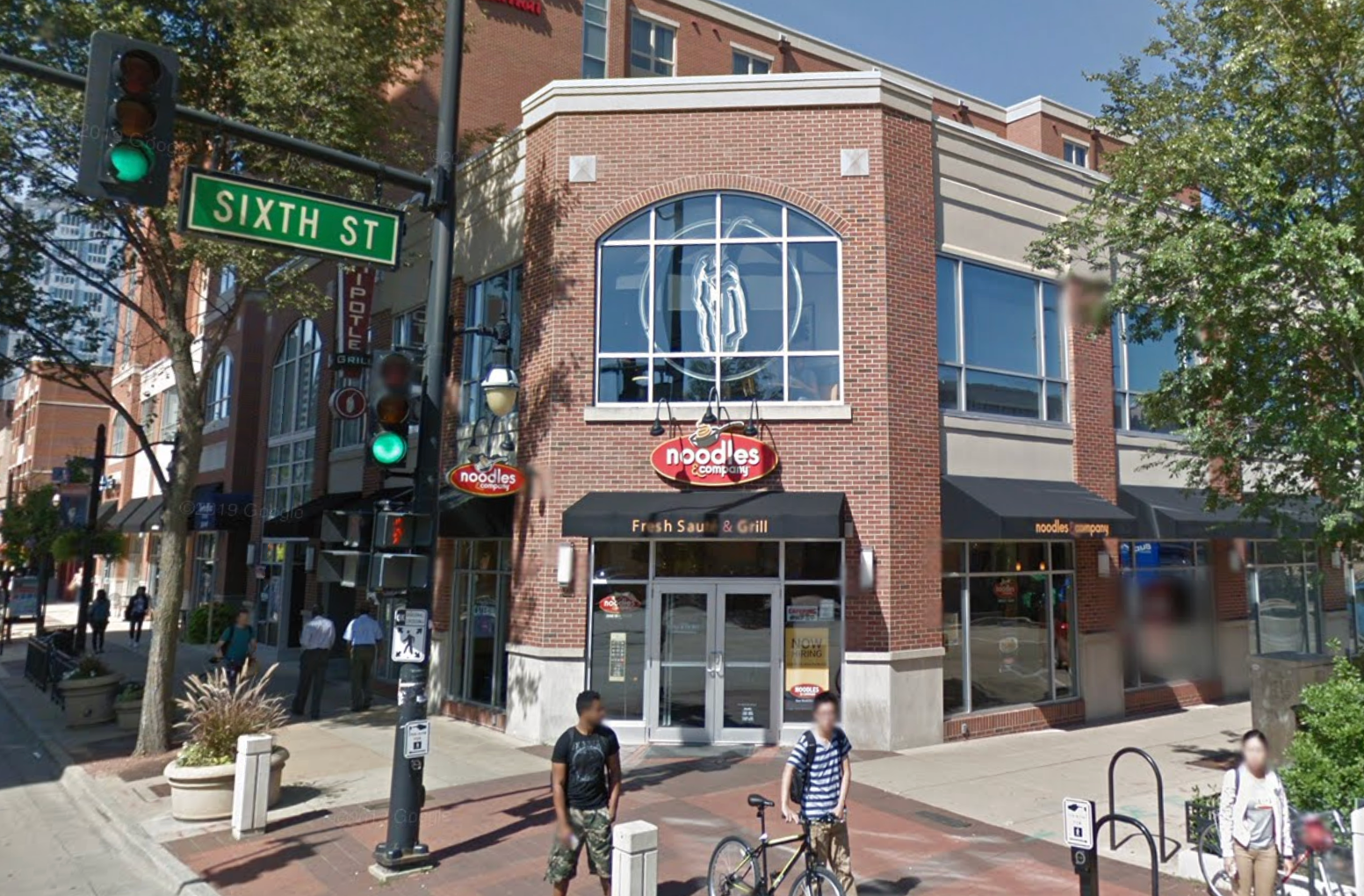

open image in galleryNoodles & Company has announced plans to axe at least 30 locations in 2026, as part of a strategic review (Google Streetview)

open image in galleryNoodles & Company has announced plans to axe at least 30 locations in 2026, as part of a strategic review (Google Streetview)The noodle company has not yet confirmed which sites could soon face closure.

In the statement, Christina said that last year’s performance had been a major driver in the company’s decision to shutter even more restaurants. In 2025, the firm reported sales growth of 7 percent in the fourth quarter for its company-owned restaurants, up from four percent in the third quarter.

However, despite this, the company’s statement says that it has been forced to look at “strategic alternatives” to maximise its shareholder value.

In recent years, the company has battled to remain on the Nasdaq list after failing to maintain a minimum share price of $1 for more than 30 consecutive trading days in December 2024 and later in June 2025, according to The Street.

open image in galleryThe noodle company has been burdened by financial woes since it started trading publicly in 2013 (Google Streetview)

open image in galleryThe noodle company has been burdened by financial woes since it started trading publicly in 2013 (Google Streetview)Currently, the company is listed on the Nasdaq as having a share price of $0.84 (as of January 16, 2026).

That means the company’s shares have lost 97 percent of their value since the firm first went public in 2013, when a single share cost around $36.75, according to the Nasdaq.

However, Christina was optimistic about the brand’s prospects in this week’s press release.

“As we head into 2026, we are energized by the progress we are making and confident in our plan to develop winning teams, drive guest satisfaction, ignite growth, and deliver improved financial results,” Christina wrote.

The Independent has contacted Noodles & Company for comment.

More about

RestaurantsColoradoFoodAmerican foodJoin our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments