- Home

Edition

Africa Australia Brasil Canada Canada (français) España Europe France Global Indonesia New Zealand United Kingdom United States Edition:

Global

Edition:

Global

- Africa

- Australia

- Brasil

- Canada

- Canada (français)

- España

- Europe

- France

- Indonesia

- New Zealand

- United Kingdom

- United States

Academic rigour, journalistic flair

Academic rigour, journalistic flair

Floodwaters surround a house and vehicles in Abbotsford B.C., on Dec. 12, 2025.

THE CANADIAN PRESS/Ethan Cairns

The climate insurance gap is widening, and it’s leaving marginalized Canadians behind

Published: December 21, 2025 1.57pm GMT

Anne E. Kleffner, University of Calgary, Derek Cook, Ambrose University, Mary Kelly, Wilfrid Laurier University

Floodwaters surround a house and vehicles in Abbotsford B.C., on Dec. 12, 2025.

THE CANADIAN PRESS/Ethan Cairns

The climate insurance gap is widening, and it’s leaving marginalized Canadians behind

Published: December 21, 2025 1.57pm GMT

Anne E. Kleffner, University of Calgary, Derek Cook, Ambrose University, Mary Kelly, Wilfrid Laurier University

Authors

-

Anne E. Kleffner

Anne E. Kleffner

Professor, Risk Management and Insurance, University of Calgary

-

Derek Cook

Derek Cook

Director, Canadian Poverty Institute, Ambrose University

-

Mary Kelly

Mary Kelly

Chair in Insurance and Professor, Finance, Wilfrid Laurier University

Disclosure statement

Derek Cook is the Director of the Canadian Poverty Institute that receives funding from The Co-operators Insurance Company. The Canadian Poverty Institute is also a partner with The Resilience Institute on a collaborative project that is funded by the Canada Mortgage and Housing Company (CMHC).

Mary Kelly has received funding from Finance Canada and the Social Sciences and Humanities Research Council of Canada. She is also on the board of directors of Heartland Mutual Insurance Company.

Anne E. Kleffner does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Partners

University of Calgary provides funding as a founding partner of The Conversation CA.

University of Calgary provides funding as a member of The Conversation CA-FR.

View all partners

DOI

https://doi.org/10.64628/AAM.axgmrdgxq

https://theconversation.com/the-climate-insurance-gap-is-widening-and-its-leaving-marginalized-canadians-behind-270417 https://theconversation.com/the-climate-insurance-gap-is-widening-and-its-leaving-marginalized-canadians-behind-270417 Link copied Share articleShare article

Copy link Email Bluesky Facebook WhatsApp Messenger LinkedIn X (Twitter)Print article

Every year, extreme weather events wreak havoc across Canada, disrupting the lives of tens of thousands. Financial losses from these events have surged, surpassing $7 billion in 2024, due in part to climate change, asset accumulation and more people living in high-risk areas.

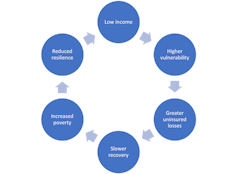

Evidence from Canada, the United States and Europe shows that weather-related disasters aren’t experienced equally. The people hardest hit are often those with the fewest resources to cope.

Lower-income and marginalized populations face greater exposure, have fewer resources to prepare or recover and incur a higher proportion of losses not covered by insurance.

Graph of insured losses from 1983 to 2024, adjusted for inflation.

(Mary Kelly)

Graph of insured losses from 1983 to 2024, adjusted for inflation.

(Mary Kelly)

Even if they are insured, many people have difficulty covering the deductible because they lack emergency savings. This means damage is not repaired, people live in unsafe or unhealthy conditions and the financial and personal risk of future events is increased.

Insurance helps households recover and can prevent them from falling — or falling deeper — into poverty after a disaster. But across Canada, insurance is becoming costlier and, in some places, harder to get. Between 2019 and 2023, average home insurance premiums rose by 21 per cent overall. For lower-income Canadians, that increase was 40 per cent.

A widening protection gap

Canada’s growing insurance protection gap is a serious concern, and it’s widening at a time when weather-related disasters are becoming more frequent and more severe.

When households are uninsured, losses can strain household budgets and leave people unable to meet their basic needs. As extreme weather escalates, so does the likelihood that more families will find themselves unable to recover.

How natural disasters affect marginalized populations.

(Mary Kelly)

How natural disasters affect marginalized populations.

(Mary Kelly)

Affordability is the primary driver of the protection gap, but it is not the only one. Many Canadians do not understand the benefits of insurance, or underestimate the probability and cost of suffering a loss.

Accessibility to insurance is also a challenge, especially in remote areas where it is usually purchased in person. While the growth of digital purchasing channels helps, it is not a solution for those without reliable internet or sufficient digital skills.

Finally, the market itself does not always meet the needs of low-income or otherwise marginalized groups. There is a lack of insurance products designed for these groups, leaving many without the protection they need.

A worker walks in a devastated neighbourhood in west Jasper, Alberta in August 2024.

THE CANADIAN PRESS/Amber Bracken

A worker walks in a devastated neighbourhood in west Jasper, Alberta in August 2024.

THE CANADIAN PRESS/Amber Bracken

Strengthening community resilience

Better insurance options, stronger investments in mitigation and better support for consumers can help reduce inequities and strengthen resilience.

Community-level mitigation is a good starting point. Land-use planning that steers development away from high-risk areas can prevent future losses. Programs like FireSmart, which reduces wildfire losses, and infrastructure designed for a changing climate also help limit damage as severe weather becomes more frequent.

Read more: Too little, too late? The devastating consequences of natural disasters must inform building codes

National assessments show that making housing more resilient reduces exposure for lower-income and marginalized households that are more likely to live in older or poorly maintained homes, putting them at greater risk.

While major retrofits can be costly, even small upgrades such as improving drainage, installing backwater valves or fire-resistant materials can help prevent damage. Many municipalities provide targeted subsidies and incentive programs that support these upgrades, particularly for households facing greater financial constraints.

A young girl scoots across the flooded highway 173 in Beauceville, Que., in March 2025.

THE CANADIAN PRESS/Jacques Boissinot

A young girl scoots across the flooded highway 173 in Beauceville, Que., in March 2025.

THE CANADIAN PRESS/Jacques Boissinot

Making hazard information easier to find and understand can also help ensure no one is left behind when disasters strike. Many Canadians lack clear information about the hazards they face and how to prepare for them. Some residents, including newcomers and seniors, may face barriers in accessing or acting upon available information.

Finally, community supports can further strengthen resilience. People with strong social ties and access to community organizations recover more quickly after disasters. Programs that build local networks and support neighbourhood groups can help accomplish this at a relatively low cost.

Closing the protection gap

A critical step in reducing the unequal impacts of weather-related hazards is closing Canada’s insurance protection gap. Microinsurance is one promising solution, and these simplified, low-cost policies can provide basic protection at a fraction of the cost for households that cannot afford traditional coverage.

Embedded tenant insurance — automatically included when renters sign a lease — is another approach that ensures basic coverage.

Digital tools, such as mobile-friendly sign-up platforms and plain-language policy explanations, can reduce barriers for those who struggle with technology.

Public support for income-tested premium subsidies or credits can bring essential coverage within reach for low-income households, while community-based catastrophe insurance — where local governments or community groups arrange coverage on behalf of residents — offers another option.

While Canadians can’t stop extreme weather, we can work together to prevent it from worsening inequality. Increasing awareness, reducing losses, closing insurance gaps and building resilience are key to protecting those at greatest risk.

- Climate change

- Weather

- Insurance

- Natural disasters

- Extreme weather

- Climate disasters

- Climate insurance

Events

Jobs

-

Research Fellow (Level A) - Reproductive Health

Research Fellow (Level A) - Reproductive Health

-

Product Manager, Recognition of Capabilities (ROC)

Product Manager, Recognition of Capabilities (ROC)

-

Lecturer / Senior Lecturer (Veterinary Biosciences)

Lecturer / Senior Lecturer (Veterinary Biosciences)

-

Senior Lecturer, Autism & Neurodivergent Studies/Special Education

Senior Lecturer, Autism & Neurodivergent Studies/Special Education

-

Respect and Safety Project Manager

Respect and Safety Project Manager

- Editorial Policies

- Community standards

- Republishing guidelines

- Analytics

- Our feeds

- Get newsletter

- Who we are

- Our charter

- Our team

- Partners and funders

- Resource for media

- Contact us

-

-

-

-

Copyright © 2010–2025, The Conversation

Research Fellow (Level A) - Reproductive Health

Research Fellow (Level A) - Reproductive Health

Product Manager, Recognition of Capabilities (ROC)

Product Manager, Recognition of Capabilities (ROC)

Lecturer / Senior Lecturer (Veterinary Biosciences)

Lecturer / Senior Lecturer (Veterinary Biosciences)

Senior Lecturer, Autism & Neurodivergent Studies/Special Education

Senior Lecturer, Autism & Neurodivergent Studies/Special Education

Respect and Safety Project Manager

Respect and Safety Project Manager