- Pro

Bending Spoons acquires dying tech businesses and revitalizes them

Comments (0) ()When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

(Image credit: Eventbrite)

(Image credit: Eventbrite)

- Bending Spoons acquires Eventbrite for $500 million to revive its operations

- The purchase price reflects a steep drop from Eventbrite’s 2018 IPO

- Eventbrite stockholders receive $4.50 per share, an 81% premium immediately

Bending Spoons has agreed to acquire Eventbrite for approximately $500 million, marking another addition to its portfolio of well-known but stalled software companies.

The purchase price is far lower than Eventbrite’s $1.76 billion valuation at its 2018 IPO, which reflects years of stagnant revenue and slowed growth.

The company intends to revive the brand by implementing operational changes similar to previous acquisitions, which include Evernote, Meetup, Vimeo, and AOL.

You may like-

Turns out AOL is still a thing - and it's just been bought for $1.5bn

Turns out AOL is still a thing - and it's just been bought for $1.5bn

-

Bluehost owner offloads business domain registrar Markmonitor to focus on its web hosting segment - and its seven million customers

Bluehost owner offloads business domain registrar Markmonitor to focus on its web hosting segment - and its seven million customers

-

Spotify’s upgraded live events feed lets you follow your favorite live music venues, allowing you to discover lesser-known gigs in your area

Spotify’s upgraded live events feed lets you follow your favorite live music venues, allowing you to discover lesser-known gigs in your area

Terms of the deal and investor impact

Audited financial statements show Eventbrite’s annual revenue stayed flat at roughly $325 million for both fiscal years 2023 and 2024.

This flat performance made intervention necessary to restore Eventbrite’s growth trajectory.

The agreement gives Eventbrite stockholders $4.50 per share in cash, representing an 81 percent premium over the previous day’s closing price of $2.48.

Bending Spoons values Eventbrite at roughly 1.7 times its trailing twelve-month revenue of $295 million.

Are you a pro? Subscribe to our newsletterContact me with news and offers from other Future brandsReceive email from us on behalf of our trusted partners or sponsorsBy submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over.While this multiple appears low compared to high-growth tech acquisitions, the structure reflects the company’s intent to focus on profitability rather than rapid expansion.

Eventbrite’s stockholders gain immediate returns, while Bending Spoons positions itself to manage long-term operations without pressure from external exits or short-term investment horizons.

Bending Spoons follows a model of acquiring companies with strong brands but stagnant business performance.

You may like-

Turns out AOL is still a thing - and it's just been bought for $1.5bn

Turns out AOL is still a thing - and it's just been bought for $1.5bn

-

Bluehost owner offloads business domain registrar Markmonitor to focus on its web hosting segment - and its seven million customers

Bluehost owner offloads business domain registrar Markmonitor to focus on its web hosting segment - and its seven million customers

-

Spotify’s upgraded live events feed lets you follow your favorite live music venues, allowing you to discover lesser-known gigs in your area

Spotify’s upgraded live events feed lets you follow your favorite live music venues, allowing you to discover lesser-known gigs in your area

Unlike traditional private equity firms, the company plans to hold Eventbrite indefinitely.

It aims to increase profitability through operational efficiencies, cost reductions, pricing adjustments, and product feature improvements.

This strategy mirrors approaches used by other investors in similar “venture zombie” companies.

Examples include Constellation Software, Curious, Tiny, SaaS.group, Arising Ventures, and Calm Capital.

According to Andrew Dumont, founder of Curious, such firms buy companies at low valuations and adjust them quickly to target 20 to 30 percent profit margins.

Eventbrite’s history as a private company includes raising approximately $330 million in venture capital from top-tier investors such as Sequoia Capital and Tiger Global Management.

Bending Spoons’ recent funding round of $270 million valued the company at $11 billion, which gives it substantial capital resources to support acquisitions.

Eventbrite’s established presence in the events and ticketing market gives Bending Spoons a brand it can leverage.

The company plans to implement operational changes, including cost management, pricing strategies, and product enhancements, to drive performance.

That said, it remains uncertain how quickly these measures can achieve meaningful results, given the complexity of revitalizing a stalled business.

Via TechCrunch

Follow TechRadar on Google News and add us as a preferred source to get our expert news, reviews, and opinion in your feeds. Make sure to click the Follow button!

And of course you can also follow TechRadar on TikTok for news, reviews, unboxings in video form, and get regular updates from us on WhatsApp too.

Efosa UdinmwenFreelance Journalist

Efosa UdinmwenFreelance JournalistEfosa has been writing about technology for over 7 years, initially driven by curiosity but now fueled by a strong passion for the field. He holds both a Master's and a PhD in sciences, which provided him with a solid foundation in analytical thinking.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.

Logout Read more Turns out AOL is still a thing - and it's just been bought for $1.5bn

Turns out AOL is still a thing - and it's just been bought for $1.5bn

Bluehost owner offloads business domain registrar Markmonitor to focus on its web hosting segment - and its seven million customers

Bluehost owner offloads business domain registrar Markmonitor to focus on its web hosting segment - and its seven million customers

Spotify’s upgraded live events feed lets you follow your favorite live music venues, allowing you to discover lesser-known gigs in your area

Spotify’s upgraded live events feed lets you follow your favorite live music venues, allowing you to discover lesser-known gigs in your area

Will X's usage-based API pricing succeed in winning over developers?

Will X's usage-based API pricing succeed in winning over developers?

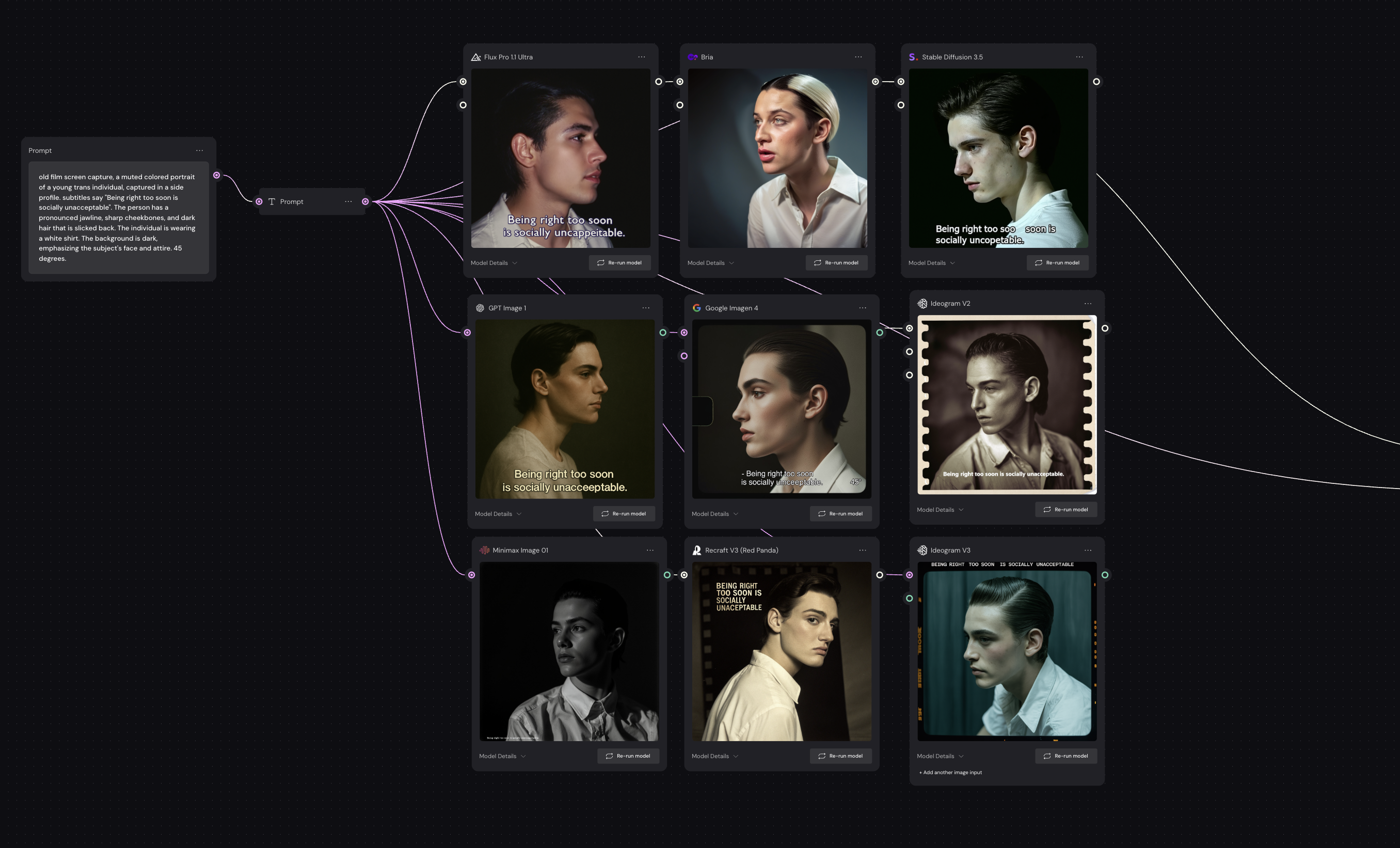

Figma boosts its AI editing tools as it combines forces with popular AI platform Weavy

Figma boosts its AI editing tools as it combines forces with popular AI platform Weavy

I am so tired of tech services subscription culture, and Blink's Arc is the latest example

Latest in Pro

I am so tired of tech services subscription culture, and Blink's Arc is the latest example

Latest in Pro

AWS Graviton5 is its most powerful and efficient CPU to date - and could mean big changes for your key cloud workloads

AWS Graviton5 is its most powerful and efficient CPU to date - and could mean big changes for your key cloud workloads

Start 2026 strong - you can save up to 50% on Wix’s top apps right now

Start 2026 strong - you can save up to 50% on Wix’s top apps right now

Customer data stolen in Freedom Mobile account management platform hack

Customer data stolen in Freedom Mobile account management platform hack

CEOs are warning AI adoption and spending should be more strategic

CEOs are warning AI adoption and spending should be more strategic

Apple Final Cut Pro (2025) review

Apple Final Cut Pro (2025) review

This DDoS group just smashed the previous record with a 29.7 Tbps attack

Latest in News

This DDoS group just smashed the previous record with a 29.7 Tbps attack

Latest in News

Roblox, FaceTime become the last targets of Russia's censorship

Roblox, FaceTime become the last targets of Russia's censorship

Marvel Rivals now has a gacha mini-game featuring a limited-time Psylocke bundle – here's how it works

Marvel Rivals now has a gacha mini-game featuring a limited-time Psylocke bundle – here's how it works

YouTube to lock out under-16s in Australia as controversial social media ban looms

YouTube to lock out under-16s in Australia as controversial social media ban looms

Forget Spotify Wrapped, get back into CDs with FiiO’s gorgeous new portable player

Forget Spotify Wrapped, get back into CDs with FiiO’s gorgeous new portable player

Sony announces partnership with Bad Robot Games to produce and publish a new four-player, co-op shooter from Left 4 Dead director

Sony announces partnership with Bad Robot Games to produce and publish a new four-player, co-op shooter from Left 4 Dead director

Can you guess which pro Canon camera took the best landscape photo of 2025?

LATEST ARTICLES

Can you guess which pro Canon camera took the best landscape photo of 2025?

LATEST ARTICLES- 1Bending Spoons continues its spree of buying famous tech brands with the Eventbrite deal

- 2This tiny white tower packs an RTX 5060 GPU and a Ryzen 9 8945HX CPU, but looks nothing like a mini PC

- 3The AI race explodes as HPE deploys AMD’s Helios racks, crushing limits with Venice CPUs and insane GPU density

- 4Scientists engineer erbium molecular qubits that plug directly into existing fiber networks, promising telecom-ready quantum systems

- 5CEOs are warning AI adoption and spending should be more strategic